Trusted by top brands in tech and finance

Success stories – Transforming businesses with ADVANCE.AI

Partnering ADVANCE.AI for success

Showcasing our solutions

In the news

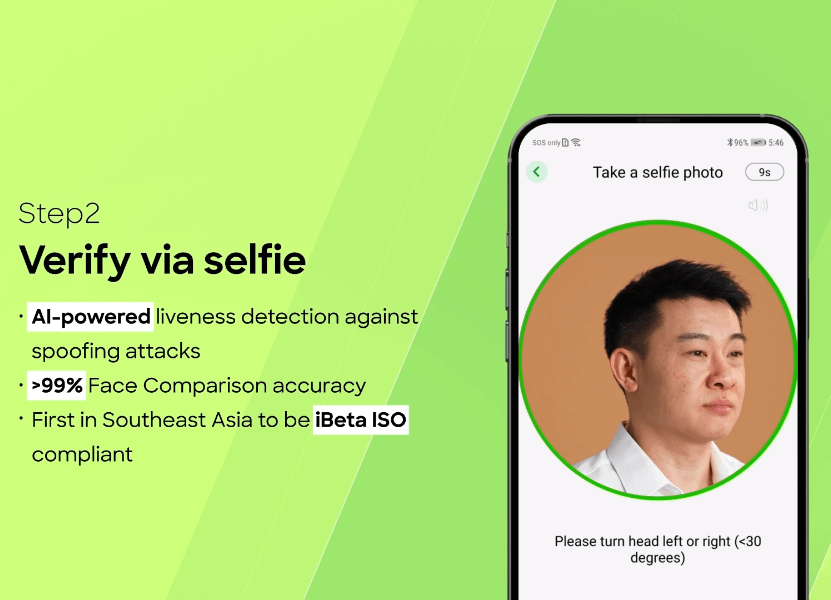

Discover the power of ADVANCE.AI

Visit us atADVANCE.AI

Follow us

Join our Community of Trust and Innovation in KYC/AML Solutions

Contact us

Questions, business development, media and partnerships, and careers – we’re here for it all.